China has surpassed France to become Cameroon’s second-largest export market, reflecting a broader shift in African trade dynamics as the continent increasingly turns toward Asia for economic partnerships.

- China has overtaken France as Cameroon’s second-largest export market, highlighting shifting trade dynamics in Africa.

- Cameroon’s exports to China surged by 8.7 percentage points in 2024, driven predominantly by oil and gas.

- France, once Cameroon’s primary trading partner, has slipped to fifth place, indicating diminished influence in the region.

- The Netherlands remains the leading importer of Cameroonian goods, majorly cocoa and crude oil.

Cameroon’s trade map is undergoing a historic transformation as China surpasses France to become the country’s second-largest export destination, reflecting a broader continental shift in Africa’s economic alignments.

According to new data from Cameroon’s National Institute of Statistics (INS), China imported goods worth 535.1 billion XAF from Cameroon in 2024 accounting for 16.5% of total exports, while France’s share tumbled to just 5.7%.

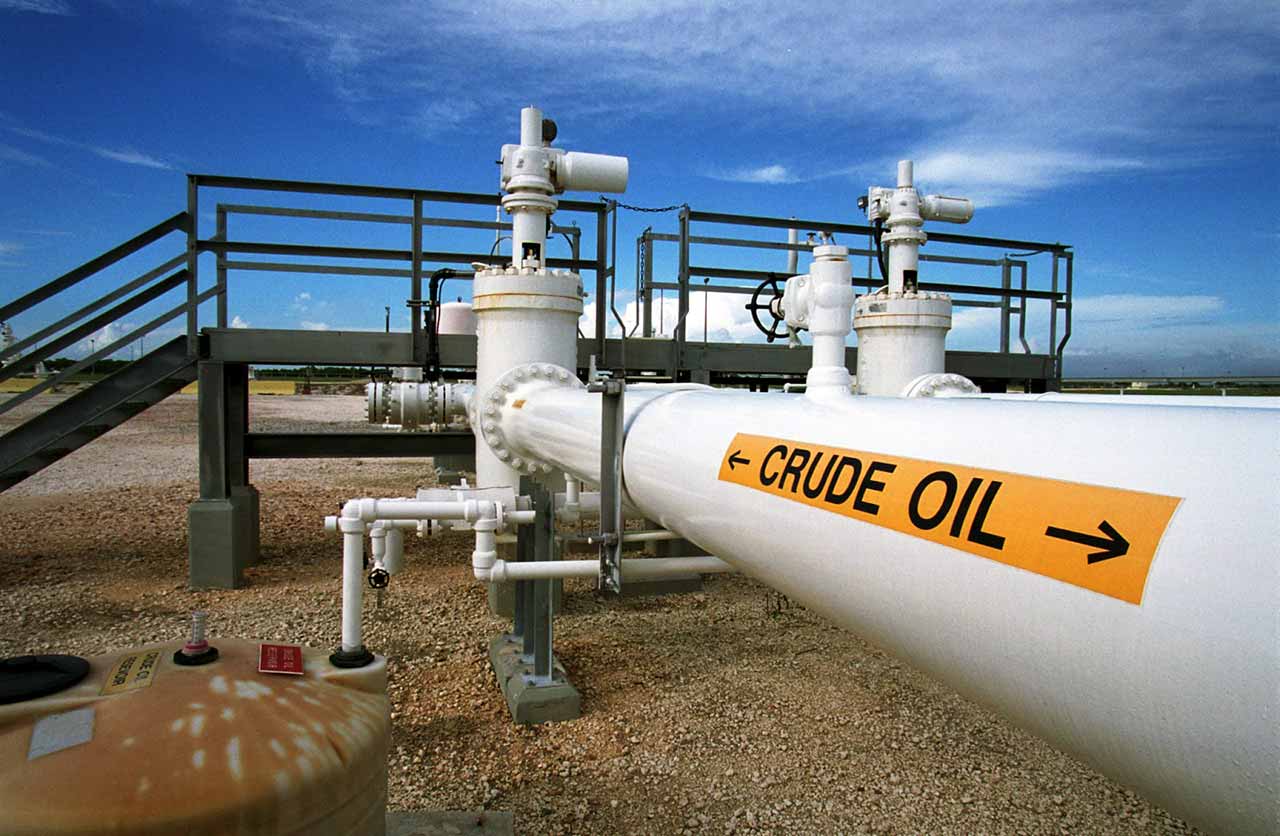

The change marks an 8.7 percentage point surge in exports to China in a single year, driven largely by oil and gas shipments. Crude oil alone represented 83% of Cameroonian exports to China, while natural gas contributed another 8%.

France, once the dominant buyer and political ally, has slipped to fifth place, signaling the erosion of its long-standing influence in the Central African nation.

“The Netherlands remains Cameroon’s leading customer in 2024, thanks primarily to cocoa and oil,” the INS report said, noting that the European country accounted for 19.2% of Cameroon’s exports, led by cocoa (53.6%) and crude oil (29.5%).

India retained third place, representing 10.1% of exports, primarily liquefied natural gas and cotton.

Cameroon Joins Africa’s Broader Economic Pivot Toward Asia

Cameroon’s reorientation mirrors a larger trend across Africa, where nations are increasingly turning to Asian partners for trade, investment, and infrastructure.

For Cameroon, China’s growing appetite for African oil and gas has provided an alternative market amid fluctuating European demand and stricter sustainability standards. Italy, another European player, has gained ground as well rising to fourth place with 206.8 billion XAF in imports but its share remains modest compared to China’s surge.

Meanwhile, Chad, once Cameroon’s main African trading partner slipped to eighth place, reflecting a regional downturn in petroleum trade and lower exports of manufactured goods within the CEMAC bloc.

Analysts say these shifts reveal Africa’s changing power dynamics, where the gravitational pull of trade is moving eastward, especially toward China and India.

Waning French Influence and the Rise of New Partners

The decline of France’s trade dominance in Cameroon also echoes the geopolitical reordering seen across West and Central Africa.

Countries in the Alliance of Sahel States (AES) – Mali, Niger, and Burkina Faso have already pivoted away from Paris, deepening ties with Russia and China while cutting formal links with ECOWAS and France-backed institutions.

Cameroon, though not part of the AES alliance, appears to be quietly following a similar economic logic: diversifying partnerships to reduce dependency on its former colonial power.

For Beijing, the growing trade volume with Cameroon cements its role as a critical economic partner in Central Africa, part of a wider Belt and Road strategy that now links resource-rich African economies directly to Asian industrial demand.